STAY ALERT, STAY SAFE!

For a smooth and stress-free experience, always verify SA Home Loans branch and consultant details here on our official website. Remember, we’ll never ask for any fees or monies to be paid upfront.

4 Sept 2018

6 Good Reasons for Switching to SA Home Loans

You’ve had a home loan with your bank for some time now and everything is ticking along smoothly. Other service providers aren’t necessarily going to be able to offer you a better rate (a common reason for switching loans), so why would you even think of switching over to someone else? Good question! The simplest answer is Quick Cash.

Why Switch home loans?

Homeowners often switch home loan providers to access the equity that has built up in their property over time. Clients who move their home loan over to SA Home Loans, for example, can almost immediately access some of the additional equity in their property – up to R150 000 within 72 hours. We call this ‘Quick Cash’.

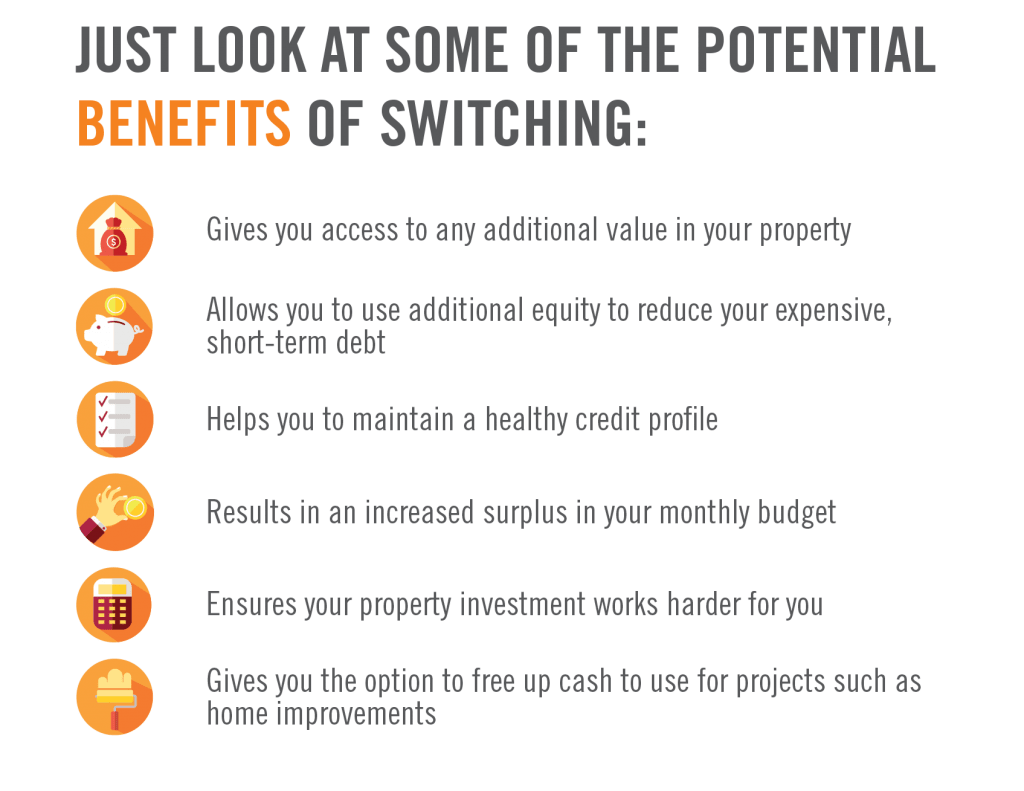

Accessing the equity in your property is probably the cheapest form of credit you can find. Clients often then use their Quick Cash to consolidate their short term debt – by paying off additional debt and “consolidating” it into a home loan repayment – which has many benefits, including improving their credit profiles for future loan applications. This Quick Cash can also be put towards paying for renovations or home improvements to increase the value of their property, or investing or purchasing big ticket items.

The infographic below summarises some of the main benefits of switching your home loan to SA Home Loans.

Quick Cash calculation tool

Our online Switch Calculator is quick and simple to use and will quickly let you know if you’ll be saving money by moving your existing home loan from your current bond provider to SA Home Loans. Include how much cash out you need from Switching to see if changing home loans will provide you with the credit you need.

Apply online to Switch to SA Home Loans

Click here to complete your online Switch Application today or leave your details and we'll call you back.